Medicare Basics

Rest easy knowing you have help covering your healthcare expenses

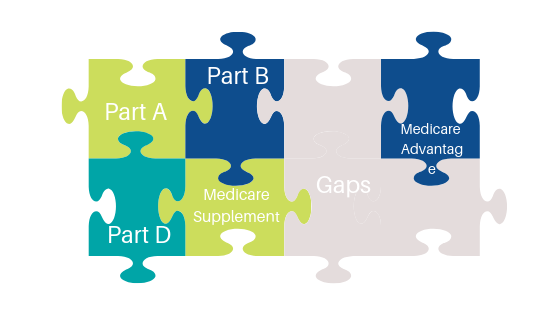

Part A

- Part A provides inpatient coverage.

- Inpatient care in a hospital

- Skilled nursing facility care (not custodial or long-term care)

- Hospice care

- Home health care

Part B

- Part B provides outpatient/medical coverage.

- Medically necessary services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice.

- Preventive services to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

Medicare Supplement insurance (Medigap)

Medicare Supplement policies help pay all or some of the health care costs that Medicare approves but does not cover, like:

- Copayments

- Coinsurance

- Deductibles

Some Medigap policies also cover services that original Medicare doesn’t, like medical care when you travel outside the U.S.

If you have original Medicare Parts A and B and you buy a Medicare Supplement plan, here’s what happens:

-

- Medicare will pay it’s share of the Medicare-approved amount for covered health care costs.

- Then, your Medigap plan will pay it’s share, depending on the plan benefits.

- Finally, if there is a balance owed, you will be responsible for that.

Medigap policies don’t cover everything.

Medigap plans generally don’t cover long-term care, vision or dental care, hearing aids, eyeglasses, or private-duty nursing.

Part C or Medicare Advantage

Medicare Part C, also known as Medicare Advantage, is offered by private insurance companies. These plans cover health care costs the same way original Medicare covers them, and in many ways even better. They also offer other benefits and services that original Medicare will not cover. In many cases, these plans also include Part D coverage.

As a note, Medicare Supplements and Medicare Advantage plans do not work together. If you have a Medicare Supplement and you are purchasing a Medicare Advantage policy you will want to cancel you Supplement when the Advantage plan is in force.

For more detailed information on which type of plan would work for you please contact me.

Part D or Prescription Drug Coverage

Medicare Part D, the prescription drug benefit, is offered through many private insurance companies and covers most prescription drugs. Each plan offers it’s own formulary, or list of covered drugs. Each individual plan may differ from the others.

Most Medicare drug plans have a coverage gap (also called the “donut hole”). If you fall into the gap during the calendar year there will be a temporary limit on what the drug plan will cover.

The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs. Once you have spent $4,020 on covered drugs in 2020, you’re in the coverage gap (aka donut hole). This amount may change each year. Also, people with Medicare who get Extra Help paying Part D costs won’t enter the coverage gap.

Extra Help

If you meet certain income and resource limits, you may qualify for a program called EXTRA HELP from Medicare to pay the prescription costs, premiums, deductibles, and coinsurance of Medicare prescription drug coverage.

In 2020, prescription costs are no more than $3.60 for each generic/$8.95 for each brand-name covered drug for those enrolled in the program.

Some people pay only a portion of their Medicare drug plan premiums and deductibles based on their income level.

To qualify for extra help with Medicare prescription drug plan costs in 2020, your annual income must be less than $19,140 for an individual ($25,860 for a married couple living together).

Countable resources include:

- Money in a checking or savings account

- Stocks

- Bonds

Other household and personal items

Countable resources don’t include:

- Your home

- One car

- Burial plot

- Up to $1,500 for burial expenses if you have put that money aside

- Furniture

- Other household and personal items

8 things to know about Medigap policies

1. You must have Medicare Part A and Part B.

2. If you have a Medicare Advantage Plan, you can apply for a Medigap policy. However, make sure you can leave the Medicare Advantage Plan before your Medigap policy begins.

4. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you’ll each have to buy separate policies.

5. You can buy a Medigap policy from any insurance company that’s licensed in your state to sell one

6. Any standardized Medigap policy is guaranteed renewable even if you have health problems. This means the insurance company can’t cancel your Medigap policy as long as you pay the premium.

8. It’s illegal for anyone to sell you a Medigap policy if you have a Medicare Medical Savings Account (MSA) Plan.

Insurance plans that aren’t Medigap

Some types of insurance aren’t Medigap plans, they include:

- Medicare Advantage Plans (like an HMO, PPO, or Private Fee-for-Service Plan)

- Medicare Prescription Drug Plans

- Medicaid

- Employer or union plans, including the Federal Employees Health Benefits Program (FEHBP)

- TRICARE

- Veterans’ benefits

- Long-term care insurance policies

- Indian Health Service, Tribal, and Urban Indian Health plans

Dropping your entire Medigap policy (not just the drug coverage)

You may want a completely different Medigap policy (not just your old Medigap policy without the prescription drug coverage). Or, you might decide to switch to a Medicare Advantage Plan that offers prescription drug coverage.

If you decide to drop your entire Medigap policy, you need to be careful about the timing. When you join a new Medicare drug plan, you pay a late enrollment penalty if one of these applies:

- You drop your entire Medigap policy and the drug coverage wasn’t creditable prescription drug coverage

- You go 63 days or more in a row before your new Medicare drug coverage begins

When Can I Buy Medigap?

The best time to buy a Medigap policy is during your 6-month Medigap open enrollment period. During that time you can buy any Medigap policy sold in your state, even if you have health problems. This period automatically starts the month you’re 65 and enrolled in Medicare Part B (Medical Insurance). After this enrollment period, you may not be able to buy a Medigap policy. If you’re able to buy one, it may cost more.

During open enrollment

Medigap insurance companies are generally allowed to use medical underwriting to decide whether to accept your application and how much to charge you for the Medigap policy. However, even if you have health problems, during your Medigap open enrollment period you can buy any policy the company sells for the same price as people with good health.

Outside open enrollment

If you apply for Medigap coverage after your open enrollment period, many states require you to qualify through a health underwriting process. There’s no guarantee that an insurance company will sell you a Medigap policy if you don’t meet the medical underwriting requirements, unless you’re eligible for Guaranteed Issue

Send Message

By providing the information above, I grant permission for a licensed insurance agent to contact me regarding my medicare options including Medicare Supplement, Medicare Advantage, Prescription Drug plans.

Follow Me